The merger solidifies Thumb Bank & Trust’s foothold in Michigan, expanding its assets and services to better serve customers across the state.

Thumb Bank’s Growth Gains Momentum with $650 Million in Assets

In a significant development for Michigan’s financial landscape, Thumb Bancorp, Inc., the parent company of Thumb Bank & Trust, has finalized its merger with Freeland State Bank. Effective November 15, 2024, this strategic move integrates Freeland’s operations into Thumb Bank & Trust, broadening its reach and enhancing service offerings. The merger positions the newly combined entity with approximately $650 million in total assets, $340 million in loans, and $592 million in deposits.

The announcement was made on November 18, 2024, following the execution of an agreement formalized on June 27, 2024. Under the terms of the deal, Freeland State Bank officially merged with and into Thumb Bank & Trust.

“This merger marks an exciting milestone for our organization,” said Ben Schott, President and CEO of Thumb Bancorp, Inc. “Thumb Bank & Trust has been dedicated to helping our communities achieve their financial goals since 1895. With the inclusion of Freeland State Bank’s customers and employees, we are confident in our ability to deliver enhanced services and meet a wider range of financial needs.”

Expanding Services to Freeland and Beyond

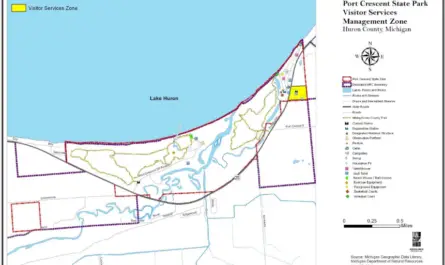

Freeland State Bank’s long-standing commitment to its community complements Thumb Bank & Trust’s legacy of service. With this merger, Thumb Bank & Trust expands its operations to Freeland, Michigan, while continuing to maintain branches across several Michigan towns, including Bad Axe, Bay City, and Sandusky.

Freeland’s customers can now access Thumb Bank’s enhanced services, such as expanded loan options and digital banking platforms. The merger also strengthens the institution’s regional competitiveness, equipping it to better serve individuals and businesses in Michigan’s evolving economic environment.

Freeland State Bank employees have been integrated into Thumb Bank & Trust’s workforce, ensuring customers’ continuity of service. Schott emphasized the importance of their expertise, stating, “Freeland’s team brings a wealth of experience, which will be invaluable as we expand our offerings and deepen our commitment to the communities we serve.”

Advisers and Future Prospects

The merger was supported by key advisers on both sides. Thumb Bancorp enlisted Hovde Group, LLC as its financial adviser and Shumaker Loop & Kendrick, LLP for legal counsel. Freeland State Bank partnered with McQueen Financial Advisors and Warner Norcross + Judd LLP for guidance through the transaction.

Looking ahead, the combined resources of Thumb Bank & Trust and Freeland State Bank are expected to create opportunities for innovation and growth in Michigan’s banking sector. The institution’s increased scale and reach will likely make it a key player in the state’s financial services industry.

Related Developments and Regional Context

This merger reflects a broader trend of consolidation in the banking industry, driven by the need for increased efficiency and competitiveness in a digital-first world. For Michigan residents, the deal underscores a commitment to preserving local banking institutions while adapting to contemporary demands.

Thumb Bank & Trust’s focus on community-driven banking aligns with the needs of Michigan’s small businesses and individual customers, ensuring it remains a trusted partner as the financial landscape evolves.

Find More Interesting Feature Stories From ThumbWind

- Michigan Features – Unveiling the people, places, and events that make the Great Lake State unique, we’ll explore hidden gems and must-do activities.

- Weird Political News – A sarcastic and insightful take on official news released by government sources, Political Action Committees and Public Officials from all over the US. All stories are true and sourced.

- Michigan News – News and events of Michigan’s Upper Thumb that are worth knowing in the region.

Your Turn – Like This, or Hate it – We Want To Hear From You

Please offer an insightful and thoughtful comment. Idiotic, profane, or threatening comments are removed. Consider sharing this story. Follow us to have other feature stories fill up your Newsbreak feed from ThumbWind Publications.