According to new University of Michigan data, consumer confidence plunged in March as inflation concerns mounted.

U of M’s Consumer Sentiment Report Plummets Amid Economic and Political Tensions

Consumer confidence across the U.S. has continued its sharp decline, with the University of Michigan’s latest Surveys of Consumers report showing an 11% drop in overall sentiment for March. The decline is broad-based, affecting all demographic groups and political affiliations. The report, released Friday, underscores growing concerns over inflation, job security, and long-term economic stability. Adding to the controversy, the Trump administration has attempted to downplay the results, blaming “Michigan people” for what it claims is a politically motivated decline in confidence.

Consumer Sentiment Hits Lowest Point in Over a Year

The Index of Consumer Sentiment, a widely watched gauge of how Americans feel about the economy, fell from 64.7 in February to 57.9 in March. This represents a staggering 27.1% drop compared to March 2024. The downward trend has persisted for three consecutive months, with overall sentiment now down 22% since December 2024. The most alarming aspect of this decline is its breadth—consumers across different income levels, education backgrounds, and political affiliations are expressing heightened anxiety about the future.

“The sharp decline in expectations reflects heightened uncertainty and concerns about economic policy,” said Joanne Hsu, Director of the University of Michigan’s Surveys of Consumers. “Consumers are struggling to plan for the future as inflation expectations continue to surge.”

Trump Administration Dismisses Michigan Survey Results

Amid growing concerns about economic stability, Kevin Hassett, Trump’s director of the National Economic Council, dismissed the University of Michigan’s consumer sentiment report, arguing that the survey is politically biased. During a Fox News interview, Hassett claimed that “a lot of Michigan people doing the survey” may have skewed the results for partisan reasons.

This statement has drawn widespread criticism, with economic experts noting that the University of Michigan’s methodology has long been considered one of the most reliable indicators of consumer confidence. Fox News anchor Martha MacCallum challenged Hassett’s assertion, pointing out that the decline in sentiment extends well beyond the election period. Hassett failed to provide any alternative data suggesting consumer sentiment was actually improving.

The claim of bias also runs counter to broader economic indicators showing rising inflation expectations and market volatility. Analysts argue that dismissing these concerns could signal deeper trouble for the administration’s ability to manage public confidence in the economy.

Inflation Concerns Drive Pessimism

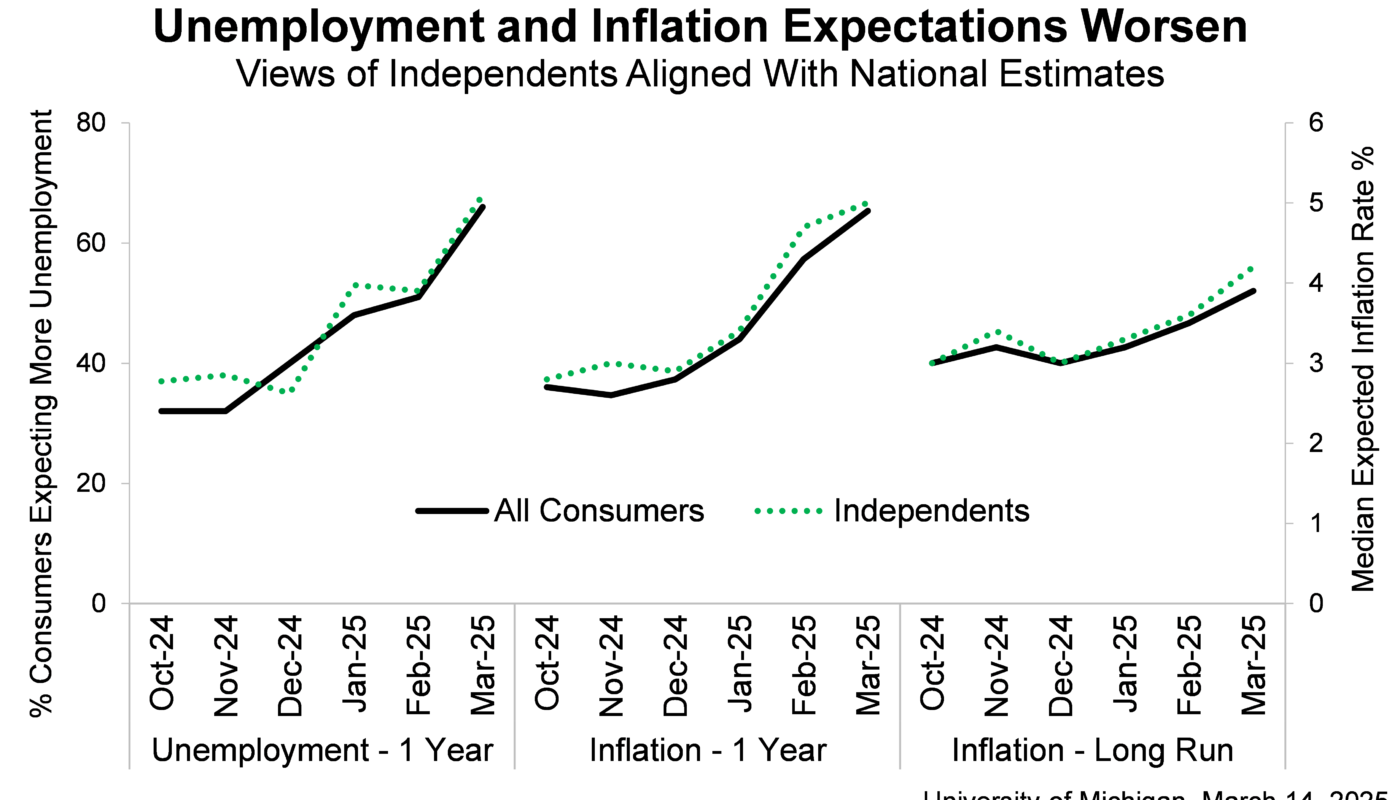

Perhaps the most striking takeaway from the report is the rapid increase in inflation expectations. Year-ahead inflation expectations jumped from 4.3% in February to 4.9% in March—the highest level recorded since November 2022. The long-run inflation outlook surged from 3.5% to 3.9%, marking the steepest month-over-month increase since 1993.

These rising expectations highlight growing consumer unease about purchasing power, the cost of goods, and the broader economic landscape. Independent voters showed the sharpest rise in long-term inflation fears, with Democrats and Republicans also expressing growing concerns.

Bloomberg reports about economic uncertainty point out the correlation. “I mean, if you’ve been watching the news and you’re not worried about tariffs and inflation, then I don’t know where you’ve been,” said Diane Swonk, Chief Economist at KPMG US. “And on the other side of it, we’ve seen very high profile layoffs, whether it be the federal government or larger firms are also doing layoffs as well. And so it’s not surprising to see some of this. But the extent to which we’ve seen it consistently deteriorate over three months time very worrisome. And we know that uncertainty was mentioned a lot as well.”

Economic Uncertainty Clouds Labor Market Outlook

The Index of Consumer Expectations, which measures optimism about future economic conditions, dropped by a striking 15.3% in March, plunging to its lowest level in over a year. This decline is reflected across several key areas of economic concern:

- Personal finances

- Labor market outlook

- Inflation pressures

- Business conditions

- Stock market expectations

Despite a stronger job market and recent wage gains, consumer confidence in long-term stability remains weak. Republicans, who had shown increased optimism after the election, saw a 10% decline in their expectations index, while Independents and Democrats posted even sharper drops of 12% and 24%, respectively.

Implications for Michigan’s Economy

For Michigan, a state heavily reliant on manufacturing, consumer sentiment plays a critical role in shaping economic trends. A pessimistic outlook can lead to decreased spending, impacting key industries such as automotive and housing. The downward trend in expectations also raises questions about business investment decisions, particularly as companies evaluate economic conditions before expanding operations or hiring workers.

With the Federal Reserve facing increasing pressure to balance interest rate hikes with economic stability, these latest findings add to concerns that continued policy adjustments may not be having the intended stabilizing effect.

Find More Interesting Feature Stories From ThumbWind

- Michigan Feature Stories – Unveiling the diverse and vibrant people, captivating places, and remarkable events that make the Great Lake State unique.

- Weird Political News – A sarcastic take on official news from around the U.S., exploring the absurdities in the political landscape.

- Michigan News – Stories from Michigan’s Upper Thumb region, including impactful interviews and community updates.

Your Turn – Like This, or Loath it – We Want To Hear From You

Please offer an insightful and thoughtful comment. We review each response. Follow us to have other feature stories fill up your email box, or check us out on ThumbWind Publications.